Are you having trouble finding a home that fits your needs and your budget? If…

With Increasing Mortgage Rates, Now’s the Time To Act

While in 2021 we became accustomed to historically low mortgage rates, in the first few weeks of 2022 we are starting to see them slowly climb. In early February, the average 30-year fixed mortgage rate from Freddie Mac jumped from 3.22% to 3.45%. That’s the highest point it’s been in almost two years. If you’re thinking about buying a home, this news may have come as a bit of a shock. But the truth is, it wasn’t entirely unexpected. Experts have been predicting increasing mortgage rates in their 2022 projections, and the forecast is now becoming a reality. Here’s a look at the projections from Freddie Mac for this year:

- Q1 2022: 3.4%

- Q2 2022: 3.5%

- Q3 2022: 3.6%

- Q4 2022: 3.7%

As the numbers show, this jump in rates is in line with the expectations from Freddie Mac. And what they also indicate is that mortgage rates are projected to continue climbing throughout the year. But should you be worried about rising mortgage rates? What does that really mean for you?

As rates increase even modestly, they impact your monthly mortgage payment and overall affordability. If you’re looking to buy a home, rising mortgage rates should be an incentive to act sooner rather than later.

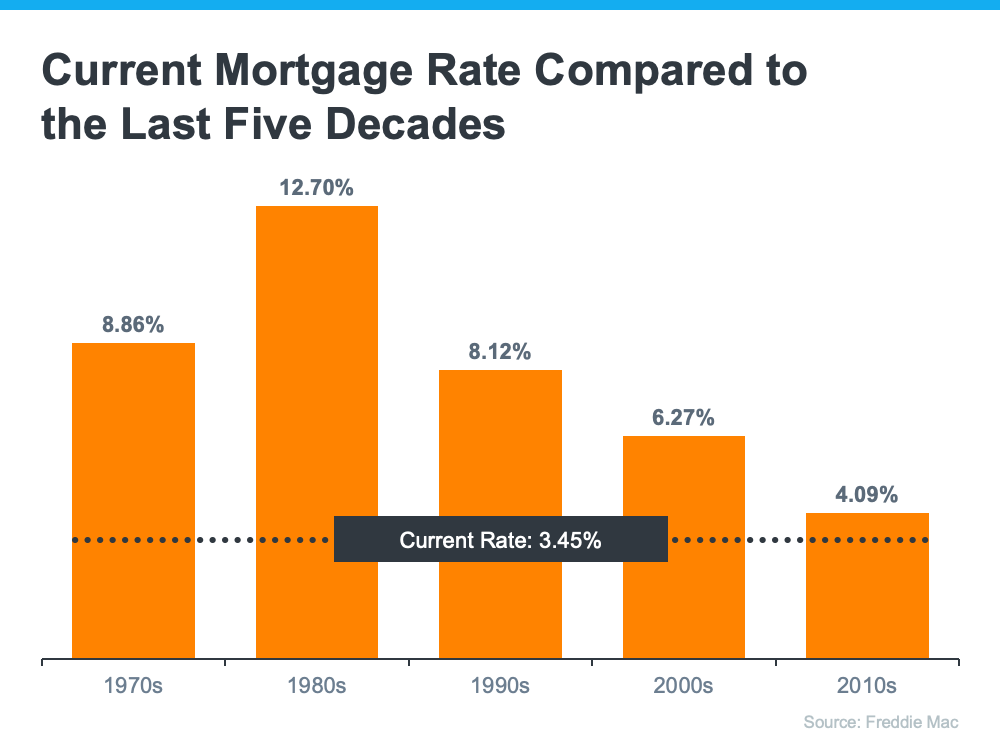

The good news is, even though rates are climbing, they’re still worth taking advantage of. Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades (see chart below):

That means you still have a great opportunity to buy now with a rate that’s better than what your loved ones may have paid in decades past. If you buy a home while rates are in the mid-3s, your monthly mortgage payment will be locked in at that rate for the life of your loan. As you can see from the chart above, a lot can change in that time frame. Buying now is a great way to protect yourself from rising costs and future increasing mortgage rates while also securing your payment amount for the long term.

Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“Mortgage rates surged in the second week of the new year. The 30-year fixed mortgage rate rose to 3.45% from 3.22% the previous week. If inflation continues to grow at the current pace, rates will move up even faster in the following months.”

Bottom Line

With increasing mortgage rates – forecast to be increase higher by the end of 2022 – now is the time to take advantage! Mortgage rates in comparison to the previous years are still low, so if you’re planning to refinance your current mortgage or to buy a home this year, acting soon may be your most affordable option. Let’s connect to start the homebuying process today!